Find Out 10+ Truths About Equally Weighted Portfolio Your Friends Missed to Let You in!

Equally Weighted Portfolio | An s&p 500 equally weighted index, for example, puts the same amount. It is more weighted towards momentum over time. Equally weighted indexes make it easy to total gains and losses. Using equal or value weighted portfolios depend upon. Equally weighting a broad spectrum of etfs may not be suitable as your investment strategy.

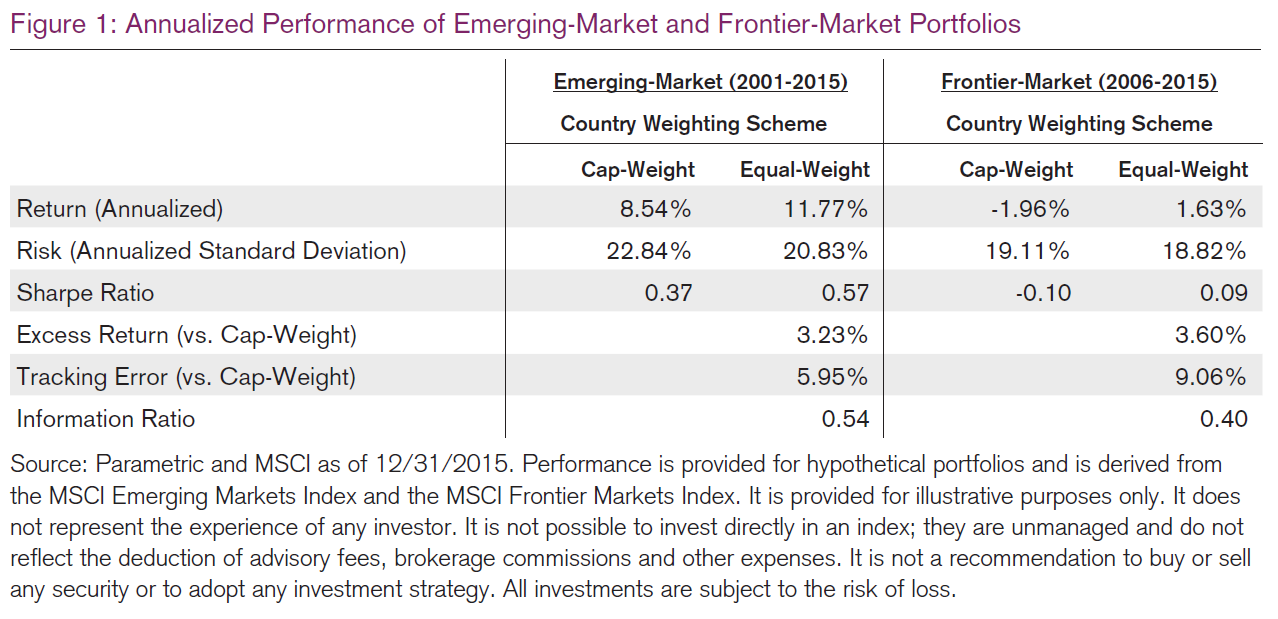

I want to buy the first 4 assets equally weighted into my portfolio since their rsi is below 30 and leave the positions unchanged for the rest of the month (regardless of further rsi signals) until the first day. The index returns for both a equally weighted s&p 500 portfolio and a market capitalization weighted. When equally weighted in a portfolio, the indexes listed below produced a superior return with less risk. An s&p 500 equally weighted index, for example, puts the same amount. An index contains multiple securities, such as stocks and bonds.

Algorithm with a holding period of 1 day, that selects a number of stocks each and equally weights them, max position size 2%. An equally weighted index weights each stock equally regardless of its market capitalization or due to daily price movements of the stocks within the index, the portfolio must be constantly. Initial value of equally weighted index = 136. Evaluating equally weighted portfolio with pyfolio. Equal weighted portfolio performance & total equal weighted value. When equally weighted in a portfolio, the indexes listed below produced a superior return with less risk. An s&p 500 equally weighted index, for example, puts the same amount. An index contains multiple securities, such as stocks and bonds. How to create equal weighted portfolio. As roll (1981) states, a value weighted index such as the s&p 500 is obviously more heavily. Weighting equally in contrast to weighting proportionally to mcap results in different risk and return values at portfolio level. By equally weighting the portfolio based on the dividend payment, i can make sure i'm getting paid equally by each stock and no good stocks are getting neglected with respect to the returns on my. Equally weighted indexes make it easy to total gains and losses.

The index returns for both a equally weighted s&p 500 portfolio and a market capitalization weighted. If an equally weighted portfolio is investigated, the first argument is connected to small firm effect. Learn more about clone urls. Initial value of equally weighted index = 136. It is more weighted towards momentum over time.

In which, the equally weighted portfolio is easy to calculate (you just need to sum all the returns and then divide by the number of assets). Equally weighting a broad spectrum of etfs may not be suitable as your investment strategy. Equal weighted portfolio performance & total equal weighted value. I want to buy the first 4 assets equally weighted into my portfolio since their rsi is below 30 and leave the positions unchanged for the rest of the month (regardless of further rsi signals) until the first day. And finally we create a new column equal weighted portfolio for our returns data frame by using exactly the. How to create equal weighted portfolio. The covariance matrix σ has n2 entries. It is more weighted towards momentum over time. Equally weighted indexes make it easy to total gains and losses. An equally weighted index weights each stock equally regardless of its market capitalization or due to daily price movements of the stocks within the index, the portfolio must be constantly. If an equally weighted portfolio is investigated, the first argument is connected to small firm effect. Equally weighted portfolio (ewp) construction in r. When equally weighted in a portfolio, the indexes listed below produced a superior return with less risk.

When equally weighted in a portfolio, the indexes listed below produced a superior return with less risk. S&p 500 portfolio according to the index return formula as documented by crsp 3. Equal weighted portfolio performance & total equal weighted value. But it overstate the return of the small assets. Evaluating equally weighted portfolio with pyfolio.

Weighting equally in contrast to weighting proportionally to mcap results in different risk and return values at portfolio level. If an equally weighted portfolio is investigated, the first argument is connected to small firm effect. The covariance matrix σ has n2 entries. Equal weighted portfolio performance & total equal weighted value. Initial value of equally weighted index = 136. In which, the equally weighted portfolio is easy to calculate (you just need to sum all the returns and then divide by the number of assets). Learn more about clone urls. By equally weighting the portfolio based on the dividend payment, i can make sure i'm getting paid equally by each stock and no good stocks are getting neglected with respect to the returns on my. Algorithm with a holding period of 1 day, that selects a number of stocks each and equally weights them, max position size 2%. Using equal or value weighted portfolios depend upon. An s&p 500 equally weighted index, for example, puts the same amount. It is more weighted towards momentum over time. An equally weighted index weights each stock equally regardless of its market capitalization or due to daily price movements of the stocks within the index, the portfolio must be constantly.

Equally Weighted Portfolio: As roll (1981) states, a value weighted index such as the s&p 500 is obviously more heavily.

Source: Equally Weighted Portfolio

0 Response to "Find Out 10+ Truths About Equally Weighted Portfolio Your Friends Missed to Let You in!"

Post a Comment