Seriously! 15+ Truths On Cash Flow To Sales Your Friends Forgot to Tell You.

Cash Flow To Sales | The direction of movement and the quantum of change must be highly correlated with the sales figures. Operational activities, investment activities and financing activities. To calculate cash flow, a business takes note of the cash available at the beginning and at the end of a specific period. Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal operations and business activities by subtracting operating expenses from total revenues. It is important for a business to root its success not only in sales or revenue figures, but also in cashflow.

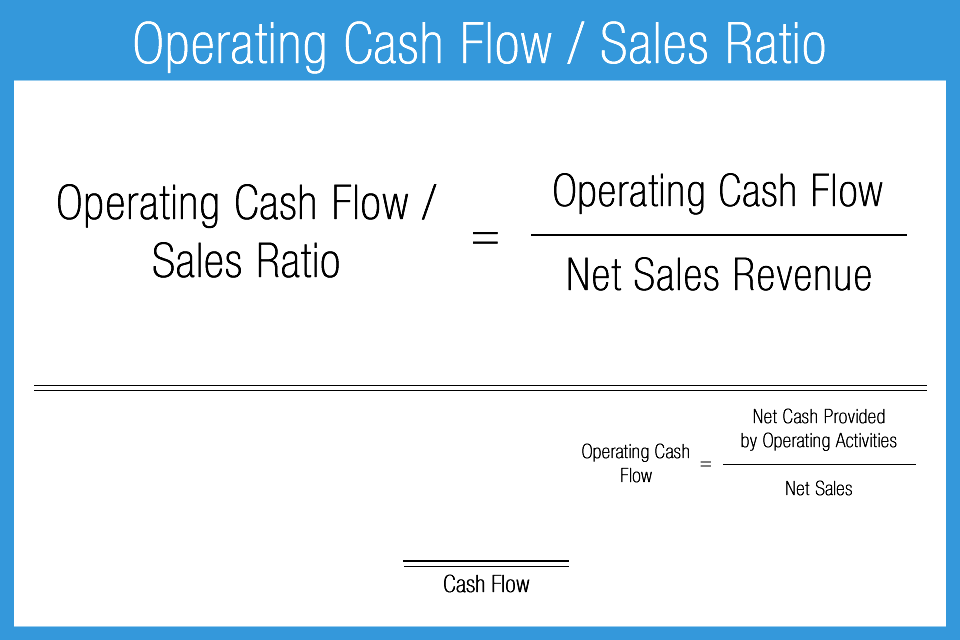

What is the definition and meaning of free cash flow to sales %? Operational activities, investment activities and financing activities. A cash flow is a real or virtual movement of money: This number can be most easily located from cash flow. This shows how much a company has generated from its identifying your operating cash flow to sales ratio :

Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal operations and business activities by subtracting operating expenses from total revenues. Cash flow is the actual amount of cash generated or lost by an entity during the course of operations. In this video you will get knowledge about free cash flow to sales. What is the definition and meaning of free cash flow to sales %? This ratio , expressed as a percentage, helps you compare your operating. A cash flow in its narrow sense is a payment (in a currency), especially from one central bank account to another; Ideally, the ratio should stay about the same as sales increase. If the ratio declines, it can be the firm must invest in more overhead as its sales increase, thereby reducing the rate of growth in cash flow. A cash flow is a real or virtual movement of money: It is calculated by dividing operating cash flows by net sales. Operational activities, investment activities and financing activities. Cash flow should move in direction and proportion with sales: Because the cash received/proceeds from the sale of the truck was $3,000 and the book value was $2,000 the difference of $1,000 is recorded in the account gain on sale of truck—an income statement account which increases the company's net income.

Cash receipts from sale of goods and rendering services. Some factors to look for in such a. Since sales activities are operational activities, sales revenue comes under the heading of operational activity income. Aside from sales, operational activity income also. That's what makes cash flow ratios so crucial to business operators and investors alike;

Fcf/sales expressed as a percentage is often used to find 'cash cow' stocks. Aside from sales, operational activity income also. If the ratio declines, it can be the firm must invest in more overhead as its sales increase, thereby reducing the rate of growth in cash flow. Cash flow should move in direction and proportion with sales: Cash flow statement shows inflow and outflow of cash and cash equivalents from various activities of a information through the cash flow statement is useful in assessing the ability of any enterprise to cash inflows from operating activities: Fcfe or free cash flow to equity is one of the discounted cash flow valuation approaches (along with fcff) to calculate the fair critical to determining capex levels required to support sales and margins in the forecast. Operational activities, investment activities and financing activities. This ratio , expressed as a percentage, helps you compare your operating. Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal operations and business activities by subtracting operating expenses from total revenues. Cash flow statements break down cash flow into three parts: A cash flow is a real or virtual movement of money: Cash receipts from sale of goods and rendering services. Cash flow from operating activities (cfo) :

Aside from sales, operational activity income also. Cash and cash flow are important mainly because it is when sales increase, so should cash flow. The term 'cash flow' is mostly used to describe payments that are expected to happen in the future. If the sales are genuine, the cash flow will move more or less in correlation with the sales figure. Getting the money upfront will improve our cash flow significantly.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Aside from sales, operational activity income also. That's what makes cash flow ratios so crucial to business operators and investors alike; A cash flow is a real or virtual movement of money: Apple for the fiscal year 2019 generated sales of $260.2 billion. If this consistency is not present, further analysis should be pursued. What is the definition and meaning of free cash flow to sales %? Cash receipts from sale of goods and rendering services. This ratio , expressed as a percentage, helps you compare your operating. Because the cash received/proceeds from the sale of the truck was $3,000 and the book value was $2,000 the difference of $1,000 is recorded in the account gain on sale of truck—an income statement account which increases the company's net income. Cash flow from operating activities (cfo) : The term 'cash flow' is mostly used to describe payments that are expected to happen in the future. Since sales activities are operational activities, sales revenue comes under the heading of operational activity income. The direction of movement and the quantum of change must be highly correlated with the sales figures.

Cash Flow To Sales: Ideally, the ratio should stay about the same as sales increase.

Source: Cash Flow To Sales

0 Response to "Seriously! 15+ Truths On Cash Flow To Sales Your Friends Forgot to Tell You."

Post a Comment